Broadview Credit Union - Your Financial Ally

When you think about where you keep your money, or where you get help with big purchases, you might think of a bank. But there's a different kind of place, one that puts its people first, and that’s a credit union. We are talking about Broadview Credit Union, a place that, you know, really aims to be a helpful hand for its members, offering financial tools and a friendly face when you need it most. It's a spot where the focus is on supporting your financial well-being, rather than just making a profit for stockholders.

This cooperative spirit means that when you join Broadview Credit Union, you're not just a customer; you're part of a larger group that shares in the benefits. It's a different way of doing things, where the goal is to serve the people who belong to it, making sure they get good deals and kind service. So, whether you are looking for a place to save a little money, or perhaps need a loan for something important, this kind of institution might just be what you are looking for, actually.

For folks in and around Broadview, Illinois, and even in parts of New York, Broadview Credit Union has been a steady presence, offering a range of services designed to make handling your money a little bit easier. They have been working to grow and serve more people, keeping up with the ways people live today while still holding onto that personal touch. It’s about being there for everyday money matters, and for those bigger life moments, too.

Table of Contents

- What Makes Broadview Credit Union Special?

- How Does Broadview Credit Union Help Its Members?

- Connecting with Broadview Credit Union

- Broadview Credit Union - A Look at Its Roots

- Broadview Credit Union - Accessing Your Money

- Broadview Credit Union - How Do You Get Started?

- Broadview Credit Union - Supporting Your Life

- What About Broadview Credit Union Beyond Illinois?

- Understanding Broadview Credit Union's Offerings

What Makes Broadview Credit Union Special?

Broadview Credit Union, especially the one located in Broadview, Illinois, really tries to give its members the best quality financial products available. This means they work hard to make sure their savings accounts, checking accounts, and loan options are, you know, quite good for the people who use them. They also put a big focus on how they treat their members, aiming for a very high level of helpfulness and kindness. It’s about making sure that when you interact with them, you feel well taken care of, which is, actually, a pretty big deal.

The idea behind a credit union is that it’s owned by the people who use its services. This means that any money made goes back to the members, often in the form of better rates on savings or lower costs on loans. So, when you choose Broadview Credit Union, you are choosing a place that, in a way, works for you, the member, rather than for faraway shareholders. This kind of setup often leads to a more personal connection and a feeling that your financial institution genuinely cares about your success.

How Does Broadview Credit Union Help Its Members?

Broadview Credit Union provides a range of ways to help its members manage their money and plan for the future. For instance, they offer different kinds of savings and loan products. These are put together with the idea of giving people good options for putting money aside or borrowing what they need. It’s about having a selection that fits various situations, so you can pick what works best for you, which is, honestly, quite helpful.

They also make it pretty simple to get information or get things done. If you want to learn more about what it means to be a part of Broadview Credit Union, you can just reach out to them. They make it easy to ask questions about their different financial products, the services they provide, or how you can become a member. This open approach means you can get the answers you need without a lot of fuss, you know.

Connecting with Broadview Credit Union

Getting in touch with Broadview Credit Union is pretty straightforward. You can simply give them a call, which is a good way to get quick answers to your questions. If you prefer talking to someone face-to-face, you can always stop by their office in Broadview, Illinois. They are there to help you out with whatever you need, whether it’s signing up or just asking about something specific. It’s about having options that fit how you like to communicate, which is, actually, quite thoughtful.

For those who like to do things from home, you can also download and print out an application to become a new member. This gives you the chance to fill things out at your own pace. And if your current workplace happens to be one of the organizations that partners with Broadview Credit Union, there might be even more advantages for you. It’s always worth checking, as these partnerships can sometimes offer special benefits to employees, so, you know, it's worth asking about.

They also make it easy to ask for more information about their financial products, the services they offer, and how to become a member. You can fill out an online form, which is a quick way to send your questions over. Or, like we said, you can call them or visit them in person. The goal is to make it as simple as possible for you to get the support you need, whenever you need it, which is, in a way, pretty convenient.

Broadview Credit Union - A Look at Its Roots

Broadview Credit Union has a history that goes back quite a ways, starting its operations in 1939. That’s a long time to be helping people with their money! Since those early days, it has really grown a lot. It started out serving a smaller group but has expanded to help people in 22 different communities. These communities are all pretty close to its main location in Broadview, Illinois. This growth shows that they have been able to meet the needs of more and more people over the years, which is, you know, a sign of their lasting presence.

Learning about their past can give you a better idea of how they have become what they are today. It’s a story of steady progress and a commitment to serving the people in their area. The staff and management at Broadview Credit Union have, actually, put in a lot of effort to make the most of the chances that came their way, especially in recent times. For instance, in 2023, because of all that hard work, the credit union saw some good things happen, which, really, helps them continue to serve their members well.

Broadview Credit Union - Accessing Your Money

Managing your money with Broadview Credit Union is made easier by their convenient online services. These services let you take care of many of your financial tasks from wherever you are, as long as you have an internet connection. This means you can check your accounts, move money around, and generally keep an eye on your finances without having to go to a physical location, which is, you know, a big help for busy people.

When it comes to getting cash, Broadview Credit Union offers a lot of options. They actually have three times more ATM locations than the three biggest national banks combined. That’s a pretty significant number, meaning you are much more likely to find a place to get your money when you need it, no matter where you are. This wide network of cash machines makes it quite simple to access your funds, which is, really, a key part of everyday money management.

If you need to order more checks, Broadview Credit Union makes that simple, too. You can place an order online, which is a quick and easy way to get it done. There’s also the option to use their mobile app, which lets you handle things right from your phone. If you prefer to talk to someone, you can contact their member service center, or just visit any Broadview branch in person. They give you several ways to handle this common task, so you can pick what works for you, which is, you know, pretty convenient.

Finding important numbers like your routing number is also made pretty clear. You can often find Broadview’s routing number at the very bottom of their website, usually in a section that’s a dark blue color. As for your own Broadview account numbers, those are typically listed on your statements or you can find them within your online account access. They try to make sure this information is accessible when you need it, which, in a way, helps keep things running smoothly.

Broadview Credit Union - How Do You Get Started?

To begin your relationship with Broadview Credit Union, you will need to become a member. This is a pretty straightforward process. For things like certificates, which are a type of savings product, membership is required. Once you have set up your account, there might be some special features available to you. For example, with an 18-month bump-up certificate, during the first six months your account is open, you might be able to tell them to change the rate, which is, you know, a nice bit of flexibility.

Accessing your Broadview account is also very easy, no matter where you are or what time it is, thanks to their digital banking and mobile app. These tools allow you to check balances, pay bills, and do other banking tasks from your computer or phone. When you apply for a loan, the quoted rates might depend on you being a credit union member at the time the loan is made. So, being a member really opens up all the services and benefits that Broadview Credit Union offers, which is, basically, the whole point.

Broadview Credit Union - Supporting Your Life

Broadview Credit Union offers various ways to support your financial life, including options for credit cards. For example, a Broadview classic credit card is available. When you apply for one of these cards, they will review your application to figure out which type of card you might be able to get. Sometimes, the rates they tell you about for these cards might include a condition that you need to be a credit union member. This means that being a part of the credit union can, you know, sometimes get you better deals on things like credit cards.

It’s good to understand that there’s a key difference between banks and credit unions. While both offer financial services, credit unions are generally not-for-profit organizations that exist to serve their members. Banks, on the other hand, are typically for-profit businesses that serve shareholders. This difference often means that credit unions can offer more favorable rates on loans and savings, and they tend to have a more personal approach to customer service, which is, actually, quite appealing to many people.

Broadview Credit Union has, over time, brought together different parts of its organization. You might see some documents that still have older names on them, what they call "legacy names." However, it’s important to remember that you are doing business with one single credit union. This streamlining helps them provide consistent service and makes things clearer for everyone, which, really, simplifies things for members.

What About Broadview Credit Union Beyond Illinois?

While we have talked a lot about Broadview Credit Union in Illinois, there is also a Broadview Federal Credit Union that serves a very large area in New York State. This institution is quite big, serving New York’s Capital Region and having 61 branches there. It is headquartered in Albany, New York, and is, actually, the fifth largest credit union in that state. It even ranks as the 40th largest credit union across the whole country, which is, you know, a pretty impressive size.

This Broadview Federal Credit Union in New York is located at places like 935 Loudon Road in Latham, New York, and 655 Patroon Creek Boulevard in Albany, New York. You can also find a branch at 920 Albany Street in Schenectady, New York. They serve nearly 500,000 account holders in New York’s Capital Region, as well as in cities like Binghamton, Syracuse, and Buffalo. This wide reach shows how much they have grown and how many people they help, which, really, is quite a lot of individuals and families.

This large credit union was formed when two leading credit unions came together. This merger allowed them to combine their strengths and serve an even larger group of people. With nearly $9 billion in assets and more than 500,000 members, Broadview Federal Credit Union is among the biggest credit unions in New York State. This size means they have a lot of resources to offer their members, which is, in a way, a significant benefit for those who bank with them.

Understanding Broadview Credit Union's Offerings

Broadview Credit Union, whether you are thinking of the one in Illinois or the larger federal credit union in New York, aims to offer a good selection of savings and loan products. They try to make it easy for members to find information about these offerings. It’s about having options for different life stages and financial goals, so you can pick what fits your situation best. They want to be a helpful resource for your money needs, which is, you know, pretty much what a credit union is all about.

The idea is to provide quality services with a personal touch. This means that the people working at Broadview Credit Union are there to assist you, answer your questions, and guide you through the various products and services. They want to make sure you feel comfortable and confident with your financial choices. This kind of support is, actually, a hallmark of the credit union difference, where the focus is truly on the people they serve.

From convenient online tools that let you manage your money from home, to a vast network of ATMs that make getting cash easy, Broadview Credit Union puts a lot of thought into how members interact with their money. They also offer different ways to get in touch, whether it’s by phone, online form, or visiting a local office. This variety of access points means you can choose the method that works best for your busy life, which is, really, quite practical.

So, if you are looking for a financial partner that prioritizes its members and offers a range of helpful products and services, Broadview Credit Union might be a good fit. They have a history of serving communities and continue to grow, always with the aim of helping people achieve their financial goals. It’s about being part of a community that works together for everyone’s benefit, which is, you know, a pretty good way to do things.

Broadview FCU

Broadview Federal Credit Union Amsterdam opening hours 5003 State

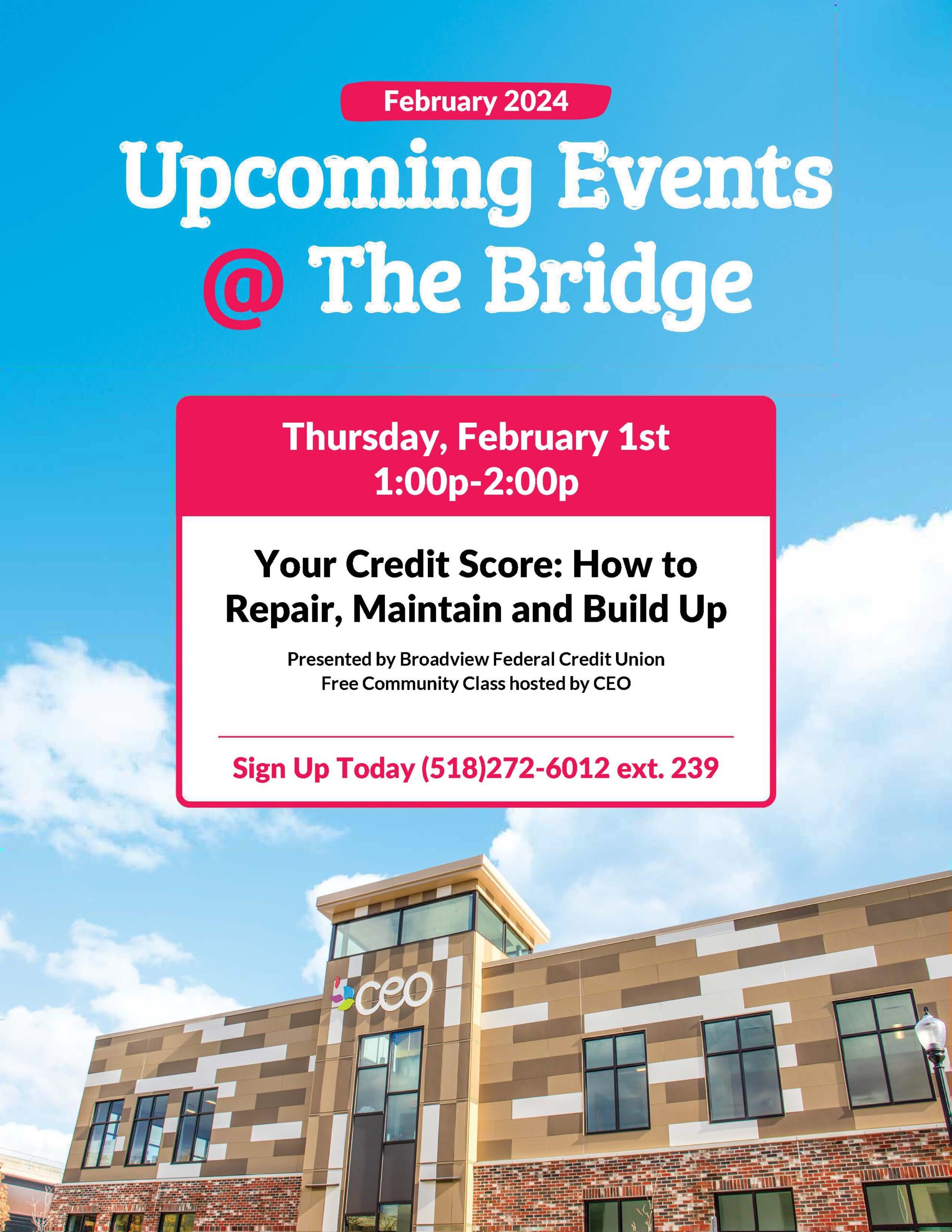

Broadview Credit Class • CEO